The Canada Revenue Agency (CRA) can process online tax returns very quickly. Many Canadians who file online get their money in about two weeks. Understanding how long does it take to get tax refund in Canada depends mostly on how you file. This guide breaks down the official timelines for every method. We’ll show you the clear steps to get your refund on the fastest track.

The Official CRA Refund Timeline

The Canada Revenue Agency (CRA) has a schedule for sending out refunds. The official CRA refund timeline is the best place to start.

Filing Method Makes a Difference

- Online Filing: This is the fastest way. If you file your taxes online and use direct deposit, you could get your refund in just 8 business days. Most people who file online get their money in about two weeks.

- Paper Filing: Sending your taxes by mail is much slower. If you file with paper forms, you should be ready to wait about 8 weeks for your refund. If you file during the busiest time of year, it could take even longer.

It’s clear that filing online is the best choice for anyone wondering, “When will I get my tax refund in Canada?”

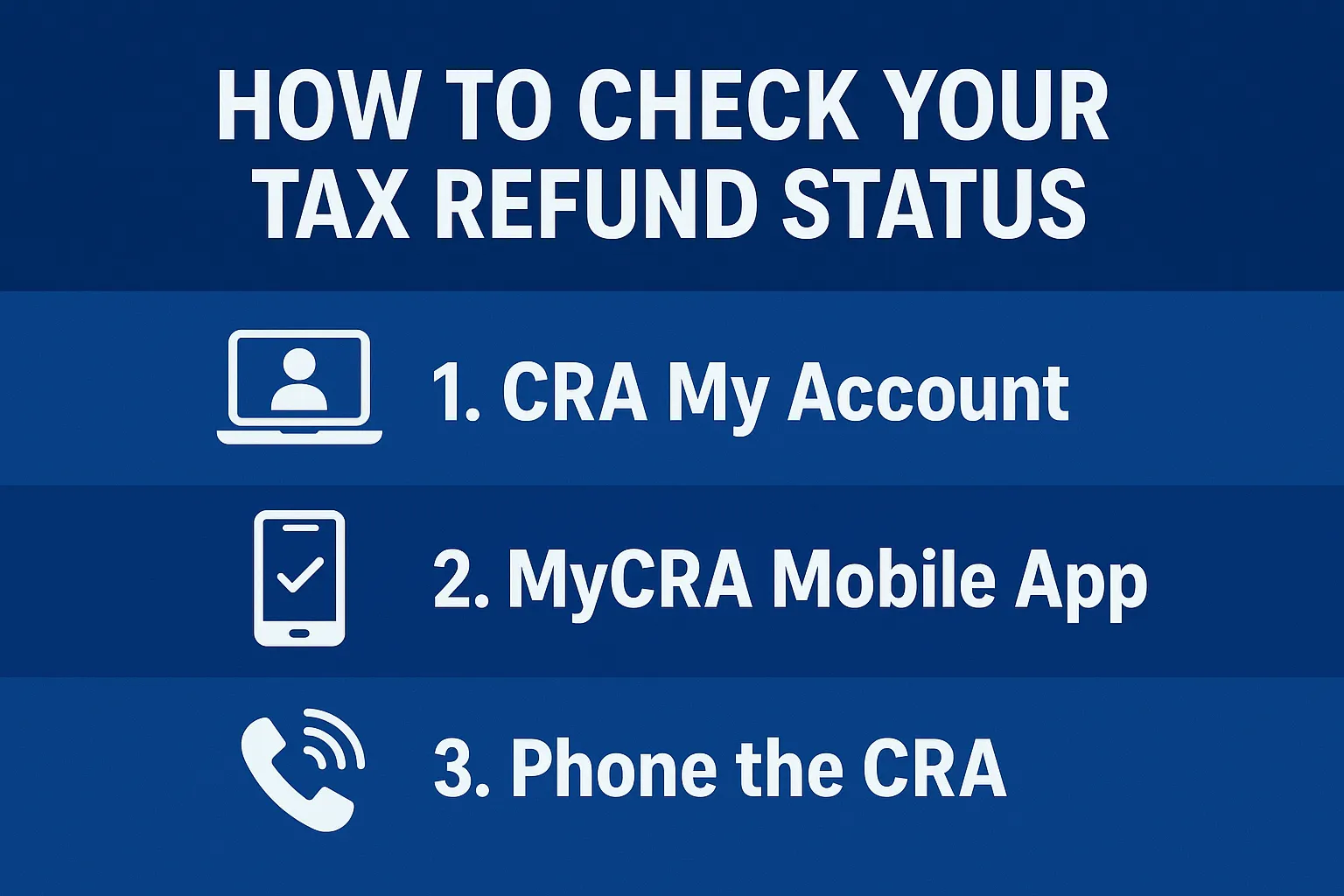

How to Check Your Tax Refund Status

You don’t have to just sit and wait for your refund to show up. The CRA has made it easy for you to see what’s going on. Here is how to check tax refund status and get an update.

- CRA My Account: This is the best way to get details. After the CRA starts processing your return, you can log in to your account online. You can see your refund status there.

- MyCRA Mobile App: This app for your phone gives you the same info as the website. It’s a very convenient way to check on the go.

- Phone the CRA: You can also call the CRA’s automated phone service. You will need your Social Insurance Number (SIN) and some details from your tax return to use it.

What Can Delay Your Refund?

Sometimes your refund might take longer than expected. Here are some common reasons why:

- There are mistakes or missing details on your tax return.

- The CRA has chosen your return for a closer look.

- You owe money to the government for other things.

- There are issues from past years, like unresolved late filing situations, that need to be sorted out.

Being careful when you file is very important. Working with the experts at Phoenix Knight can help you avoid these simple mistakes and delays.

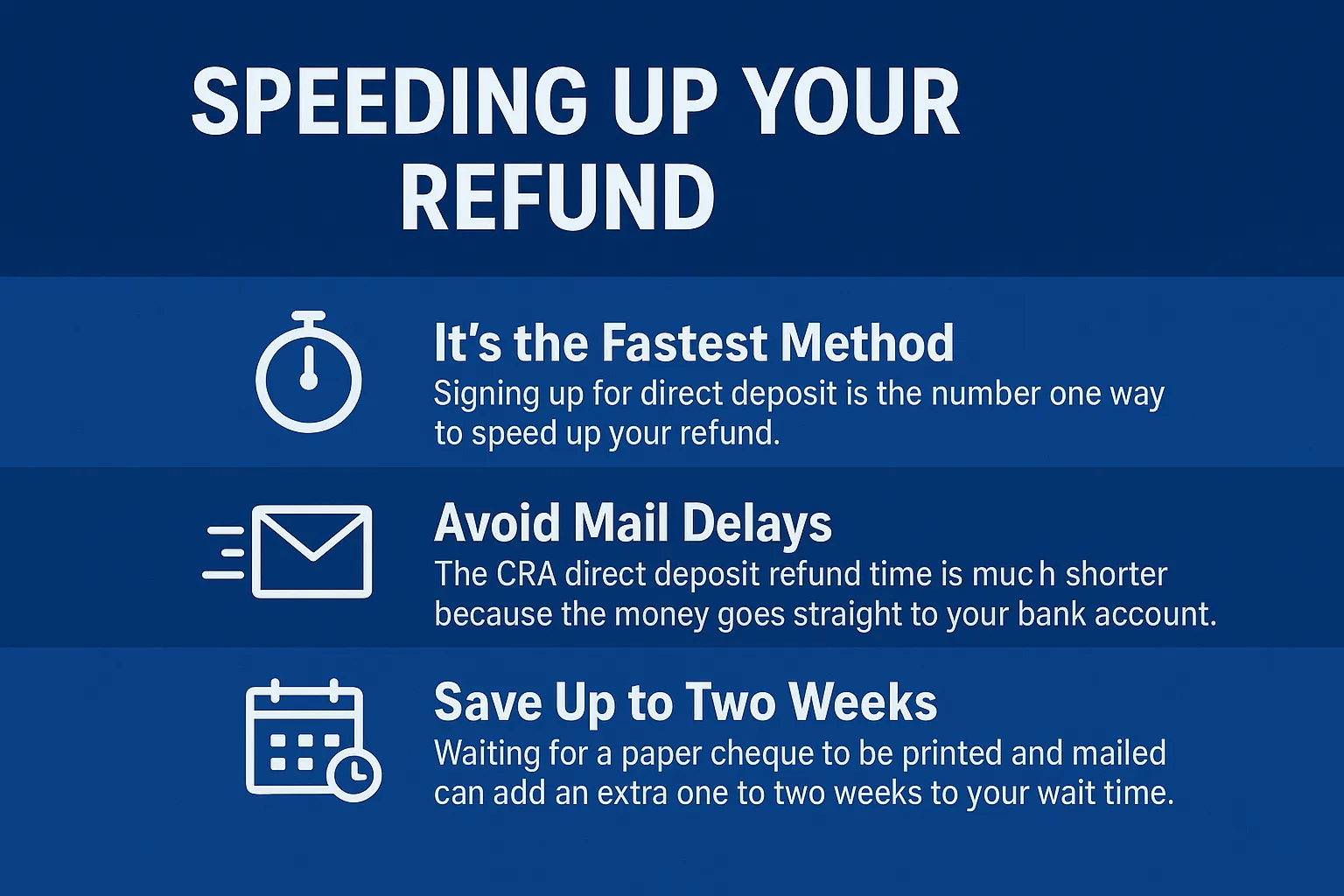

Speeding Up Your Refund: Direct Deposit is Key

To get your refund as fast as possible, direct deposit is the most important step you can take. Here’s why it makes a big difference:

Making the Most of Your Refund

Getting a tax refund is a great bonus. But using that money wisely is even better. It can be a big help for your financial goals.

Instead of just spending it, think about using your refund to pay off debt or save for the future. Thinking ahead with strategic tax and estate planning helps make sure your money is always working for you. Good planning can also help you get bigger refunds next year.

Your Next Steps for a Smooth Tax Season

Now you know the answer to how long does it take to get tax refund in Canada. Filing online with direct deposit is the fastest way to get paid. If you are facing delays or just want to plan better for next year, getting professional help is a smart move.

A little bit of expert guidance can make tax season much less stressful. If you have any questions or need a clear plan, contact us today to see how we can help.

Written by Robin DeRidder

Robin DeRidder is the founder and Principal Advisor of Phoenix Knight Financial Solutions Ltd. With over 20 years of specialized experience, he empowers Canadian businesses and individuals. Robin’s expertise lies in creating tailored tax and accounting solutions.