Smart taxpayers always plan. They realize that tax filing can be a daunting task if you do not plan. So today we shall go over the most common concerns among eligible Canadians, and that is, tax filing start and end dates in Canada. We’ve tried to provide as many details as possible with the help of experts at Phoenix Knight.

Schedule your Free Consultation

When Can You Start Filing Your 2024 Taxes?

Based on recurring trends from prior years, the Canada Revenue Agency (CRA) usually launches its electronic filing systems during the time around mid to late February.

For example, the start date for the 2025 tax season was Monday, February 19, 2025. So, for 2025’s tax filing in 2026, we can expect the starting date to be around mid-late February 2026.

Your 2025 Tax Season Calendar

Here’s what the 2024 tax filing dates looked like:

- February 19: Tax filing season begins.

- March 3: RRSP contribution deadline for the 2024 tax year.

- April 30: Tax filing and payment deadline for most Canadians.

- June 16: Tax filing deadline for self-employed Canadians.

Note: We’ll update this as soon as the dates for filing 2025 taxes in 2026 are declared officially.

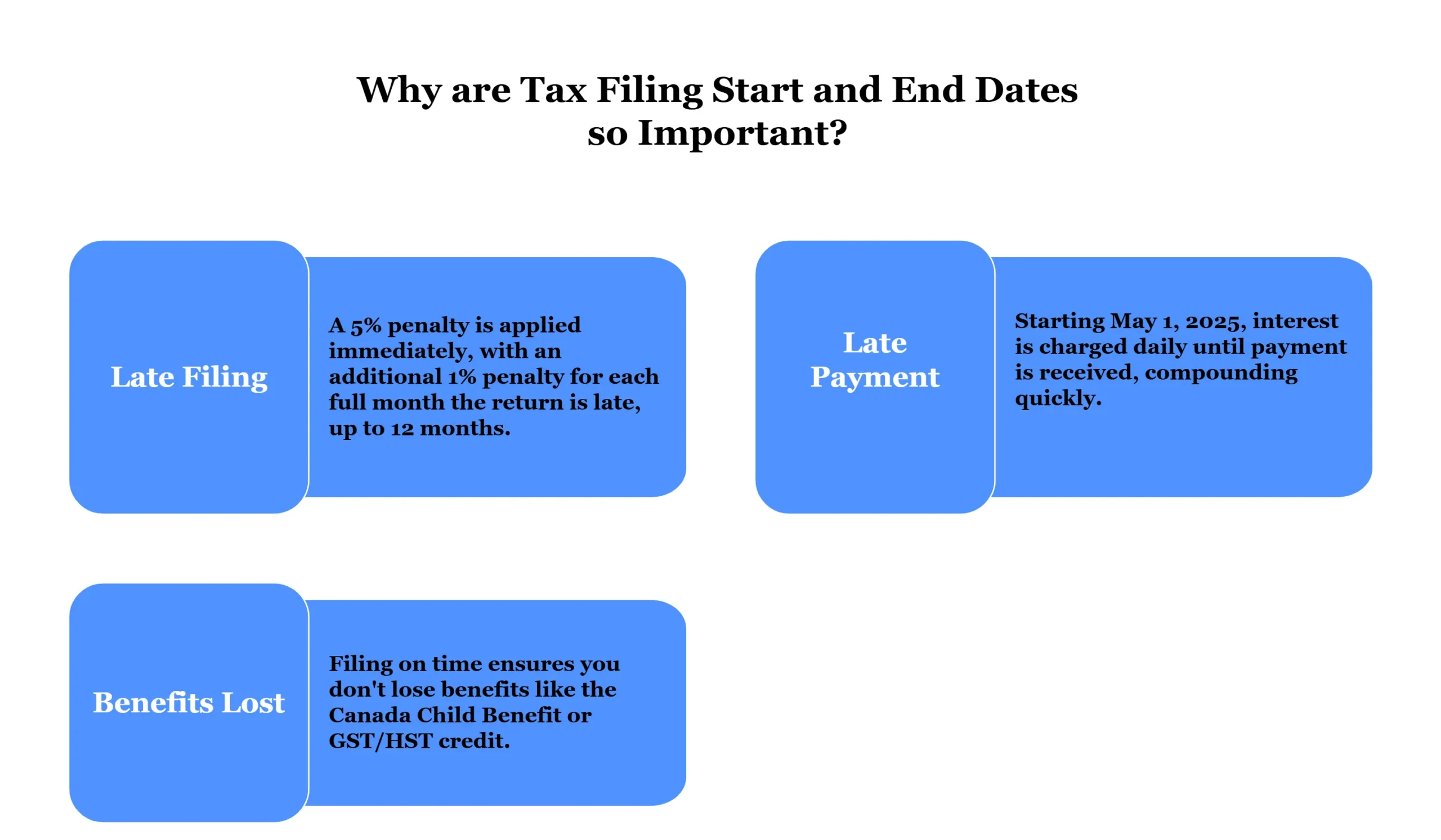

Why are Tax Filing Start and End Dates so Important?

Meeting the CRA’s deadlines has a direct financial impact in addition to being a matter of compliance. If you miss significant tax deadlines, you could lose money and benefits:

What to Do Before the Tax Filing Season Even Starts

You can set yourself up for a smooth tax season by taking a few preparatory steps now. Preparing ahead of time reduces stress and time later, especially when it comes to taxes.

Here’s how:

- Gather Your Records: Tuition forms, T4 and T5 slips, RRSP contributions, and receipts for donations or medical bills should all be kept in one location.

- Sort Business Records: To ensure nothing is overlooked, if you work for yourself, arrange your income and expenses in advance.

- Consider Life Changes: Significant life events that happened in 2024, such as marriage, the birth of a child, home ownership, or relocation, may affect your taxes.

Feeling Overwhelmed by Paperwork?

What Are the Key Tax Filing Deadlines in Canada?

Here’s an overview:

Category | Filing Deadline | Payment Deadline | Notes |

Most Individuals | April 30, 2025 | April 30, 2025 | File and pay by the same date. |

Self-Employed Individuals & Spouses | June 16, 2025 | April 30, 2025 | File later, but payment is still due April 30 to avoid interest. |

RRSP Contributions (2024 Return) | N/A | March 3, 2025 | Make contributions by this date to claim them on your 2024 tax return. |

Face Your Taxes with Confidence

To sum up, a successful tax season starts with knowing when your tax filings begin and end. Even if filing starts in February 2025, preparation is year-round and results in April. You can prevent penalties and maintain finances by being aware of the filing, payment, and RRSP contribution deadlines.

Step one is being aware of the dates; step two is seeking expert advice. Luckily for Canadians, Phoenix Knight is here to give you the precision, understanding, and comfort you are looking for when it comes to taxes.