Canada’s tax rules can feel like a tricky puzzle. You want to learn how to reduce income tax in Canada, but the rules seem confusing. We make it simple for you. This article will explain the best ways to save money on your taxes in easy-to-understand words. Keep reading to see how you can make the tax rules work in your favor.

Foundational Strategies: Maximizing Registered Accounts

The best place to start is by opening a special account that the government has made to help you save. These are great ways for anyone to find out how to reduce personal income tax in Canada.

Let’s discuss the two most important ones:

- Registered Retirement Savings Plans (RRSPs): You can take the money you put into an RRSP off your income for the year. This is one of the fastest ways to lower your taxable income in Canada. Keep in mind that you need to make your contribution before the deadline, and it’s always a good idea to keep track of important tax filing dates.

- Tax-Free Savings Accounts (TFSAs): You can’t deduct the money you put into a TFSA from your income. But any money your investments make in this account will never be taxed. This is a great way to build wealth over time without having to worry about tax bills in the future.

Unlocking Deductions and Tax Credits

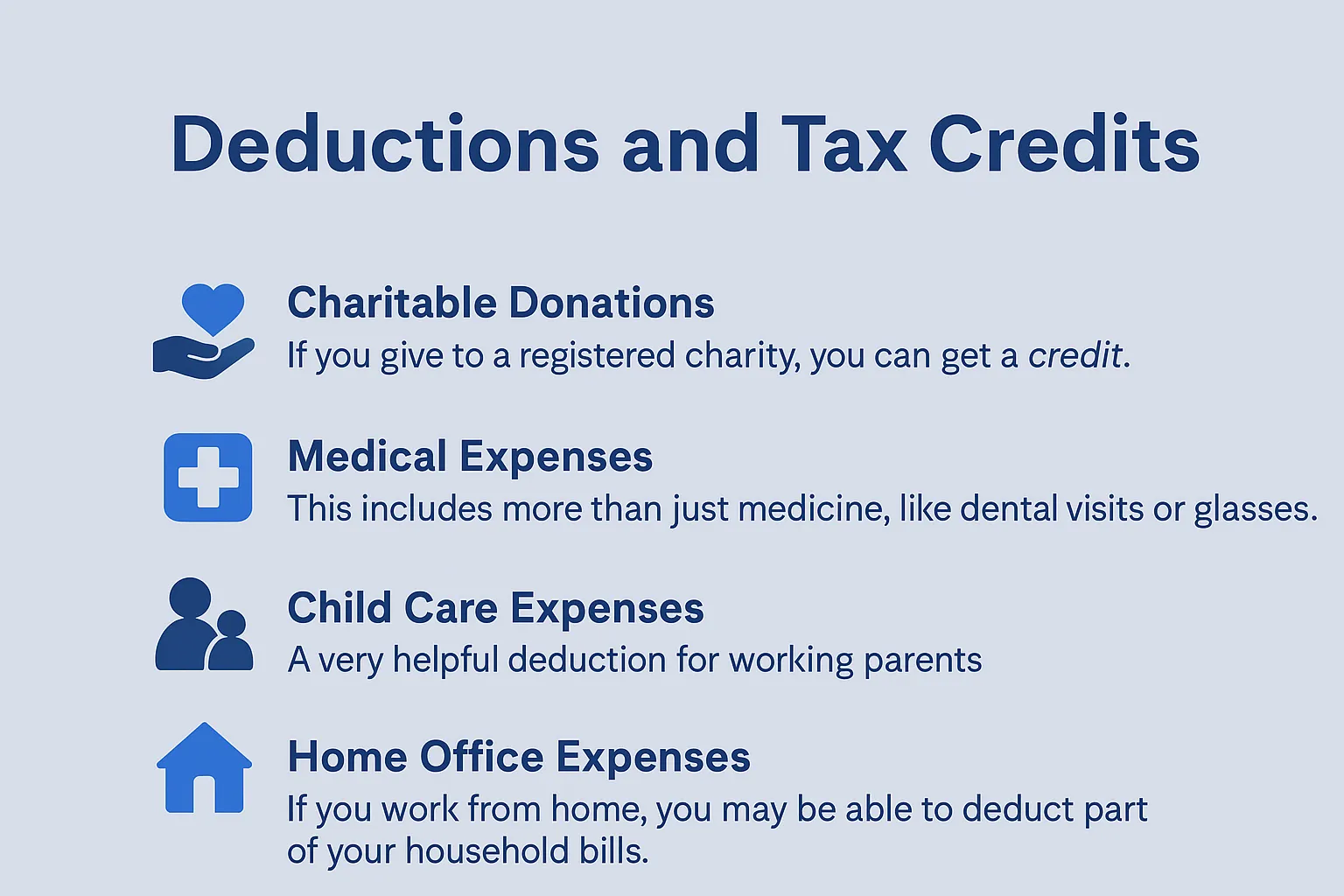

Next, let’s talk about deductions and credits. A tax deduction lowers your total income, while a tax credit directly reduces the amount of tax you have to pay. Many Canadians miss out on these because they don’t know what they can claim.

You might be able to claim things like:

Getting help from Phoenix Knight’s team of experts can help you make sure you don’t miss out on any money.

Business Owners Should Use These Smart Tactics

You can lower your taxes in ways that are only available to business owners. Smart planning and good record-keeping are the keys to learning how to reduce corporate income tax in Canada.

Advanced Tax Reduction and Wealth Preservation

Thinking about your taxes shouldn’t just be a once-a-year thing. True financial success comes from planning for the future. Proactive planning helps you save much more money in the long run.

This is about building a strong financial future for you and your loved ones. Effective wealth preservation requires strategic tax and estate planning. This approach helps you grow your assets wisely and create a lasting legacy.

The Golden Rule: Stay Compliant and Plan Ahead

So, how to reduce income tax in Canada? It’s a mix of all the things we’ve talked about: using RRSPs, claiming all your deductions, and using smart business strategies. But the most important thing to do is to take action.

It’s always better to plan ahead than to try to fix things later. To avoid stress and avoid paying unnecessary late filing fees, it’s important to stay organized and meet deadlines. Don’t put off thinking about this until tax season.

Are you ready to take charge of your taxes? Having a plan that is just for you can make a big difference. Please get in touch with us today to find out how we can help you save.

Written by Robin DeRidder

Robin DeRidder is the founder and Principal Advisor of Phoenix Knight Financial Solutions Ltd. With over 20 years of specialized experience, he empowers Canadian businesses and individuals. Robin’s expertise lies in creating tailored tax and accounting solutions.